Introduction

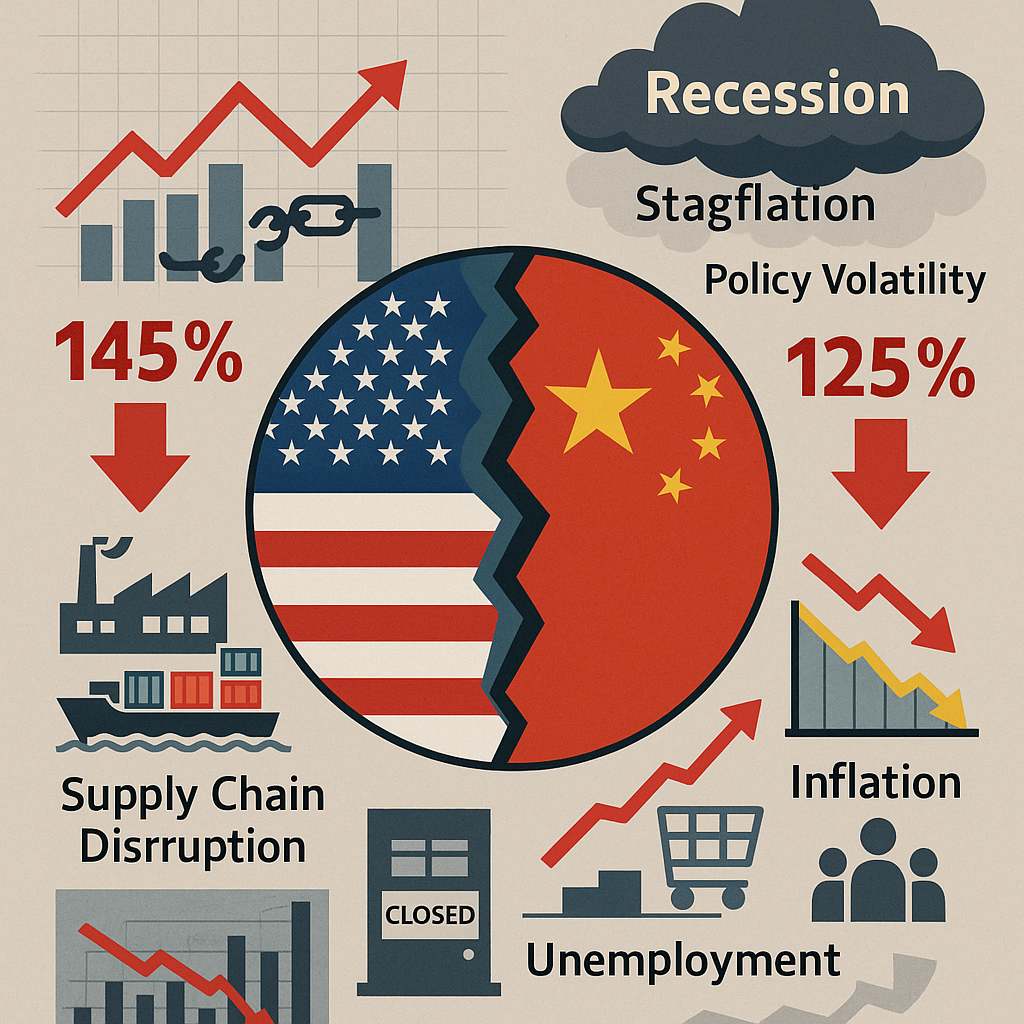

The US-China trade war, which got into the headlines during President Donald Trump’s first tenure, has reached new heights in 2025. Tariffs have reached an unprecedented level since the Great Depression. The aggressive trade policies by the US, 145% tariffs on Chinese imports and retaliatory measures of 125% tariffs by China have reshaped the geopolitics of today’s world. The tariff war is turning the world into another possible recession as it is affecting global trade and supply chains. This article analyses the impact of the aggressive policies, contrasting inflationary pressures with stagflation risks. Finally, the article will examine its impact on global markets and governance.

The Current State of US-China Tariffs

Unprecedented Tariff Rates and Revenue Impacts

Ever since taking the oath for the second Presidency, Donald Trump has been aggressive against Chinese imports. Calling for protecting its own industries, the Trump administration under the reciprocal and IEEPA tariffs imposed up to 145% of tariffs on Chinese imports. The administration has also imposed tariffs on other trading partners, including the EU, Canada, and Mexico. As per economists, the tariff measures are projected to raise $2.1 trillion in revenue over a decade. It would be the largest US tax hike since 1993.

In retaliation for the US policies, China imposed 125% tariffs on all US exports. Similarly, Canada and the EU imposed retaliatory levies affecting $330 billion of US goods. This impacted the cross-border trade between the countries. Reports indicated that the Port of Los Angeles saw a 35% drop in cargo arrivals

Supply Chain Disruptions

The impact of the tariff war was not only seen in the stock exchange but the ports of the US. For instance, the Los Angeles port anticipated a 30-50 day recovery period even if tariffs were lifted tomorrow. It is pertinent to mention that the Los Angeles Port handled 52% of imports in 2024. As ports got dried, trucking activities also plummeted to holiday-level lows. Famous retailers in the US, like Walmart, have also warned of empty shelves by mid-May.

Similarly, disruptions were also delayed at East Coast ports, including New York and Savannah, as the shipments got stuck in the Panama Canal. Industries which were majorly dependent on Chinese imports are now looking for alternatives. But the alternatives are costly and also not up to the standards of Chinese goods.

Inflation vs. Stagflation: A Delicate Balance

Tariffs and Price Pressures

According to economists, the short-term inflation due to the ongoing tariff war has already driven a 2.3% rise in US consumer prices. It is estimated to be equivalent to a $3800 annual loss per household in the US. Food prices rose 2.8%, vehicle costs 8.4%, while apparel prices surged 17%.

Analysts have already warned that 2025’s 2.7% projected inflation will stem directly from trade barriers. It is estimated that in 2021-23, the inflation was only 2%, and it was mainly driven by pandemic-era supply shocks. J.P. Morgan has also highlighted stagflation risks as tariffs could reduce GDP growth to 1.3% in 2025.

Stagflation Triggers

The tariff war would also largely impact household consumer spending. The households which fall in the category of bottom income would have to cut discretionary spending as the households have to face 4.9% disposable income losses. Similarly, Trump’s aggressive policies are also impacting low-wage workers due to rising apparel costs. Auto industries have also taken a hit with price hikes reported up to $9000 per vehicle.

In economic terms, if a country has cheaper and accessible inputs, its output would grow. The output manufacturing of the US is contracting as the tariff war has raised input costs. Due to the same effect, the Federal Reserve projects 740,000 job losses by year-end and unemployment rises up to 0.6% points.

Global Recession Risks and Systemic Fragility

The U.S.-China Spillover

The world’s economists assess that the tariff war will spill over into the economies of major economic powers and consequently affect lower- and middle-tier economic partners. As per the IMF, the GDP growth of the US would be 1.8%, and China could face a 0.6% long-term decline in GDP in 2025. As an important trading partner of the US, Canada could see its economy shrink by 2.2%.

Economists are also calling for a possible global recession as a result of the ongoing tariff war, particularly due to dwindling business confidence and supply chain fragmentation. As per J.P. Morgan, there is a 60% chance of a global recession. Similarly, the Economist Intelligence Unit (EIU) has also predicted a 2.5% GDP loss for China by 2025 if tariffs persist.

Emerging Markets and Regional Shifts

To sustain the effects of the trade war, countries are looking for alternatives. Regional trade alliances are gaining more importance in today’s geopolitics. South-South trade is now competing with North-North flows and even with greater success.Due to this shift, countries like Vietnam — whose GDP was revised from 6.5% to 5.3%—and Malaysia are absorbing diverted supply chains.

Economists estimate that the EU economy may grow by 0.1% due to the ongoing tariff war. But it is pertinent to mention that a weaker economy would not only impact the EU but also all those who are business partners with the bloc, and consequently, their growth would also decline.

Long-Term Implications and Policy Crossroads

The Fragmentation of Globalization

It is true that regional trade, like the US-Mexico-Canada partnership in the face of global trade, is gaining importance due to the ongoing tariff war. But it still faces hurdles. Production across the countries and regions is not the same around the world. For example, China controls 87% of rare earths, and the Congo supplies 64% of cobalt—both of which remain irreplaceable. This would also impact the green tech and defence sectors in the long run.

The rise of tariff wars undermines multilateral institutions, including the World Trade Organisation. Countries, like China and the USA, have started operating in a parallel world, each one looking for dominance over its rival through dictation rather than negotiations.

Policy Solutions and Risks

Risks of stagflation and inflation exist even when the Trump administration is reiterating its policy adjustments. According to Trump’s mindset, the government would spend the money collected from tariffs on tax cuts, as consumer prices soared. However, the situation is more complex than that. Rate cuts, which have been projected at 75-100 basis points, could reignite inflation. Markets are now desperately looking to stabilise as prices go down by 125 points of cuts. Moreover, the administration’s unpredictable policy adjustments suggest that policy volatility will persist.

Conclusion

The ongoing US-China tariff war is not merely a trade dispute but a threat to the global economic liberal order. While it may sound good to some in the short term but its long-term costs would be in the shape of shrinking GDP, job losses, unemployment, inflation for years to come. The world has a clear choice now whether to continue this fragmented way or to recalibrate globalisation with equitable frameworks. IMF has already signalled that the economic costs of this fragmentation could be beyond the 2008 crisis, erasing $5.7 trillion from global GDP. It’s high time for policymakers to act now to protect the global economy.